Reading Time: 2 minutes

- When one converts income-from-crime (illegal gambling, drug dealing) into legitimate money, it is called money-laundering.

- Crime is highly profitable, so, taxes & commissions don’t bother money launderers; they just want their money to become legitimate and use means (some of which are captured below) to achieve that.

- Smurfing: The launderer divides the amount among many different people (labelled smurfs), who then deposit amounts, small enough to avoid suspicion, in their accounts in different locations.

- Smurfs could be part of the team or some vulnerable individuals, who could be involved for a commission.

- They then transact with an existing business at inflated invoices (a good worth $5 priced at $50), which is associated with the money launderer, thereby, converting the dirty money into clean money.

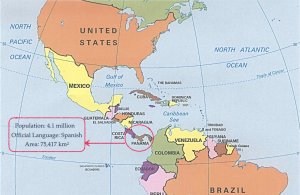

- Or they could deposit varying amounts at irregular intervals into an overseas account, which is based in places such as Panama or British Virgin Islands, which have strict laws against revealing beneficiary’s information.

- Cash-Intensive Business: Unless the business is already existing, the launderer takes loan (and use part cash payment) to open cash-intensive businesses i.e. where consumers mostly pay by cash, e.g. car washes, strip-clubs, and laundromats (money laundering gets its name from laundromats, a business that Al Capone used to clean his dirty money).

- Portions of illegal money is added to everyday’s earnings (using fake invoices) and it becomes legitimate after the taxes are paid.

- Casinos: The launderer divides money & gives it to agents, who convert this money into chips across different casino locations.

- These agents play with very little and, with an arrangement with a casino employee, convert the chips back into cash, show it as winnings and use it as legitimate after paying taxes.

- Precious Metals: The dirty money is exchanged for smuggled-gold and using fake receipts, this gold is taken overseas and sold for foreign currency, which is then converted to the desired currency.

- Shell companies: For bigger amounts, shell companies are used – a shell company is a legal company doesn’t produce anything and exists only on paper.

- There are various shell company providers available online, who can create a shell company in a country that has strict laws against revealing information; this provider also provides its own employees as executives & staff for a fee.

- The launderer opens a shell company A in Panama & hires a director X, who through his company A buys another shell company B in British Virgin Islands with a director Y, who then buys another shell company C in Seychelles.

- Company C is supposed to be a cash-intensive business, which will take the launderer’s money at inflated invoices, deposit in accounts and then purchase real-estate and other saleable assets.

- Money-laundering activities are classified into 3 stages: placement (bringing money into legitimate financial system), layering (creating multiple transactions to distance the launderer from the dirty money) and integration (dirty money comes back clean).

Image courtesy of Image courtesy of Images Money through Flickr

Reference shelf :