Reading Time: < 1 minutes

In part 1, we covered how the seeds of the current Evergrande crisis were sowed in the early 1990s. In part 2, we look at the events that led to the cracks showing up.

- Because Evergrande (the world’s most indebted developer) owes so much money, some repayment or the other becomes due every now and then.

- In the rest of 2021, it has $669 million due for payment on interests, including $83 million that was due yesterday, which the company seems to have somehow managed.

- In March 2022, another $2 billion is due.

- While the repayments had been a concern for a while, it was nowhere close to being a crisis till 2020.

- This is because the founder would turn to fellow tycoons (in the form of financial ties) or borrow more money to fund repayments or stuck projects.

- The problem began in Aug 2020, when Evergrande wrote to the government of Guangdong (the province where it was founded in 1996) that it might default on a payment due in Jan 2021.

- This letter became public and was widely circulated on social media to the company’s embarrassment, which continued to dismiss any concerns.

- This was concerning for the government, and as they dug deep, they found that it was not just Evergrande but the whole property development sector that was embroiled in debt.

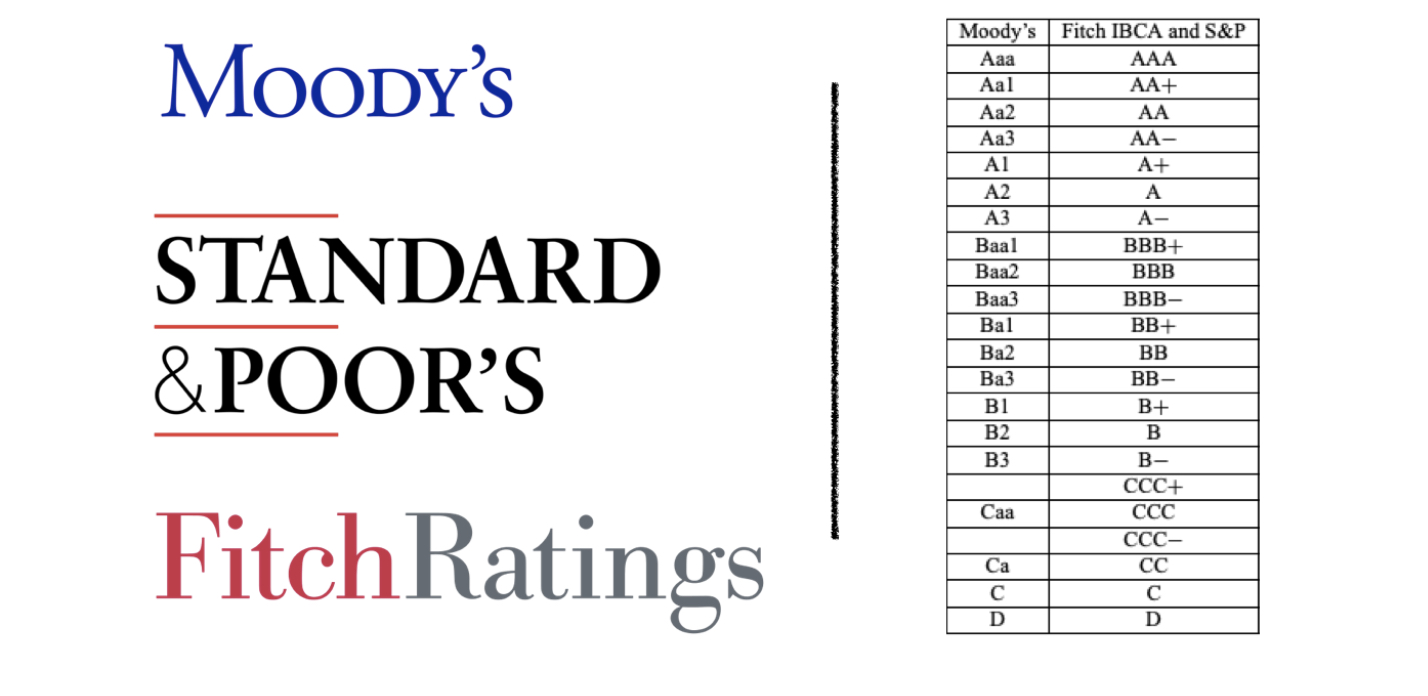

- With eight of the ten most indebted property developers based in China, policymakers had to come up with a plan to improve the situation.

- So, they imposed the three-red lines—a fancy term for new financing rules for the real estate companies.

- Under these rules, the government would set the amount of debt a real estate developer could take based on some financial factors.

- If you crossed just one red line (you are in debt, but the condition is not that bad), you could take a 10% growth in your annual debt.

- After two lines, just 5% growth; the borrowing must completely stop after you breach the third line.

- And this is where Evergrande got hit—it crossed three lines, so borrowing was no longer an option.

Image courtesy of Markus Winkler

Reference shelf :