Reading Time: 2 minutes

- To fight the great depression that started in 1929, US government took two major steps.

- it prohibited the personal possession of gold in 1933 i.e. it became illegal for people to own gold in bullion, coins or certificate form.

- And it increased the price of gold to $35 from $20.67; money, at that time, could be printed based on how much gold a country had, so with this change US could print more money.

- E.g. let us say US had 100 ounces, so it could print only $2067??US could actually print 250% of the gold but for the ease of understanding we have taken 100%; so basically it could earlier print $20.67 X 250 (and not $20.67 X 100). ($20.67 X 100) earlier but as it increased the price of gold to $35; it could print $35 X 100 = $3500??US could actually print 250% of the gold but for the ease of understanding we have taken 100%; so basically it could earlier print $20.67 X 250 (and not $20.67 X 100).

- .

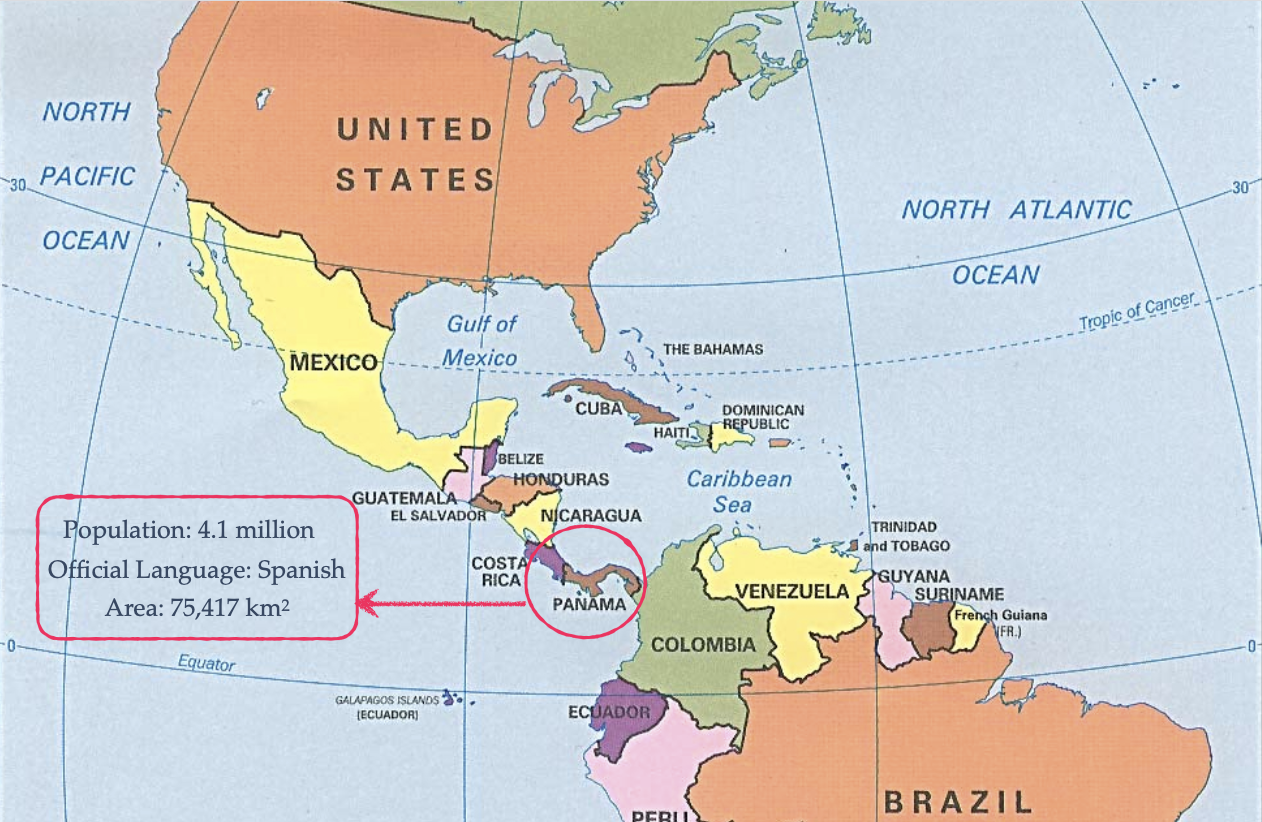

- This increase in price of gold incentivised gold miners globally to expand production and foreigners to export their gold to the United States.

- But this also meant that now $1 was worth much less?Imagine you having 2 ounces of gold and the government takes it and pays you $41.34 ($20.67 X 2); you are ok as you can buy it back when the prohibition ends, but then 1 ounce of gold becomes equal to $35, so with your $41.34 you can buy only one ounce..

- In 1939, WWII started and everyone thought it had happened because of economic problems of WWI that couldn’t be resolved.

- So, in 1944 (after the war was over), 44 countries met to find a solution to economic problems.

- All of them wanted economic stability and agreed it could be achieved by pegging their currencies to something.

- US at that time had 75% of world’s gold reserves (because of point 2, 3 & 5 as explained above).

- So the other countries, even if they wanted to, didn’t have enough gold to back their money printing.

- They decided, therefore, that they will peg their currencies to US dollar, which was pegged to gold.

- But in early 1970s, US was in Vietnam War and under pressure for more money, so it increased the price of gold from $35, first to $38 and then to $42.

- Some of the 44 countries grew concerned about the US dollar losing* value and started exchanging their US dollars with gold that US had.

- So, in 1973 US unpegged US$ from gold so that it didn’t have to pay gold for US $.

- The countries, in turn, unpegged their currencies from US$ and got into free-floating exchange rate where the currency value is determined by market forces of demand and supply.

Image courtesy of Michael Steinberg through Pexels

Reference shelf :