Reading Time: < 1 minutes

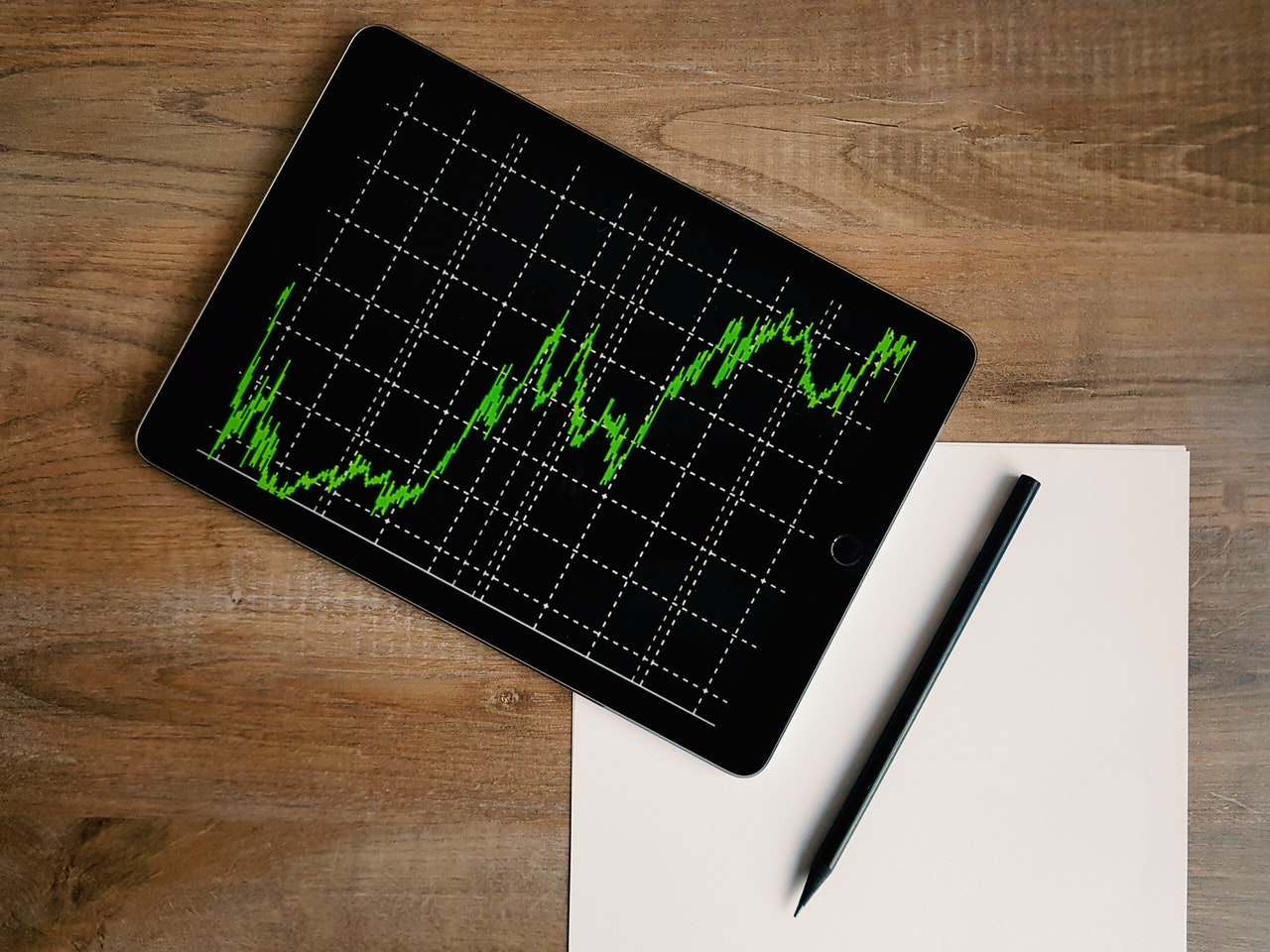

- It means Sensex is 500 times what it was on 1st April 1979.

- There are 5000+ companies whose stocks/shares can be bought or sold by people on the Bombay Stock Exchange (BSE – a market where people sell their shares and other people buy those shares).

- Out of these 5000+, some companies are well-established and have proven themselves over a number of years.

- Let us say there are 100 such companies.

- BSE picks the top 30 out of these companies and calculates their Free-Floating Market Capitalisation (FFMC).

- FFMC is equal to all the stocks available for trading (buying/selling) to common people (i.e., not held by company insiders or government, etc.) multiplied by their share value.

- E.g., Company A has 100 shares for trading, and the value of each share is priced at Rs. 20, so the total FFMC will be Rs. 2,000/-.

- FFMC of all these 30 companies is totalled, and it adds up to billions of rupees.

- Let us say this value was 403.47 Billion on 1st April 1979.

- To report and make sense of such a complicated number on a daily basis would be highly inconvenient; imagine someone saying: “Today Sensex crossed 1738.8 billion, yesterday it was 1696.48 billion.”

- So, this figure (or whatever it was on 1st April 1979) was equated to 100; this equating to 100 is called Indexing (and therefore Sensex is called Stock Market Index of 30 companies).

- When we say Sensex crossed 50,000, it means FFMC of the top 30 companies on the BSE list has become 500 times that of 403.47 Billion; it is seen as an indication of how well the Indian stock market is performing.

- While the number 30 is fixed, the composition of the group can change and is reviewed in June and December each year.

- Companies with fading performance are replaced by ones getting stronger.

- This is how all major stock market indices in the world operate.

Also Read:

Why do credit/debit cards have expiry dates?

Image courtesy of Pixabay through Pexels

Reference shelf :