Reading Time: 2 minutes

In part 1 of a 2-part series, we look at the root cause of the problem. In Part-2, we will look at specific events that landed Evergrande in the middle of this inconceivable crisis.

- The early 1990s were particularly difficult for China.

- The 1989 Tiananmen Square massacre had caused severe damage to the government’s image nationally and internationally.

- The political instability combined with poor economic growth forced the government to loosen its control over the economy.

- One of the easiest ways to boost the economy is to make borrowing cheaper—people take loans and invest, which creates job opportunities, and everything is perfect… till it is not.

- This is pretty much the China Evergrande story—as loans became cheap, land ownership increased.

- And one of the beneficiaries of these cheap loans was the now-billionaire Hui Ka Yan.

- He founded Evergrande in 1996 and expanded his real-estate business by borrowing.

- Because the Chinese government was investing in several infrastructure projects, local governments in China sold their land (often at low prices) to free money for better utilisation.

- Evergrande milked this opportunity and bought large land tracts with borrowed money and built properties.

- Cheap borrowing meant property boom—as more people bought homes, Evergrande became stronger, and banks/investors were happy to lend it more money.

- Gradually, Evergrande entered into the electric vehicle, media, theme park, and food industries.

- But the borrowing didn’t stop—today, it owes $300 billion across banks, foreign investors, hedge funds, suppliers, and people who bought apartments from Evergrande.

- The situation got so out of hand that Evergrande asked its employees to lend loans (or invest in Evergrande Wealth Management Products) to the company if they didn’t want to lose their bonuses.

- Financial stress is nothing new for Evergrande, which has avoided crises many times in the past thanks to its wealthy friends and the Chinese government’s fear of the financial instability that the fall of Evergrande could cause.

- $300 billion, after all, is a lot of money to affect millions of people and hundreds of institutes.

- The company’s collapse means tens of thousands of its workers, investors, and people who have their money invested in unfinished apartments/projects will be severely affected.

- But it had to stop somewhere—in 2018, Chinese President Xi Jinping unveiled “three tough battles” for the nation’s regulatory state: poverty, pollution, and financial risk.

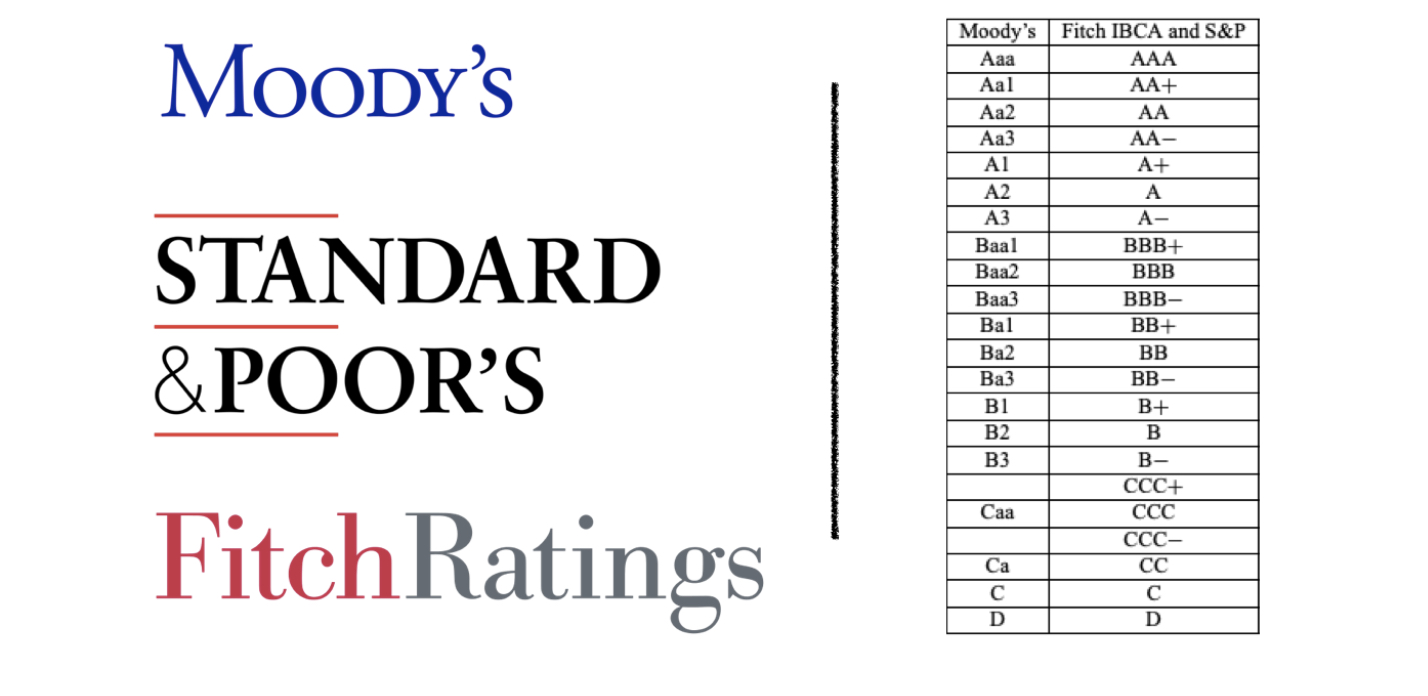

- In 2020, as a follow-up on the financial risk, the regulators imposed three red lines on developers based on their borrowing, and this is where Evergrande got into trouble.

More on this in Part-2.

Image courtesy of Ehud Neuhaus through Unsplash

Reference shelf :