Reading Time: 2 minutes

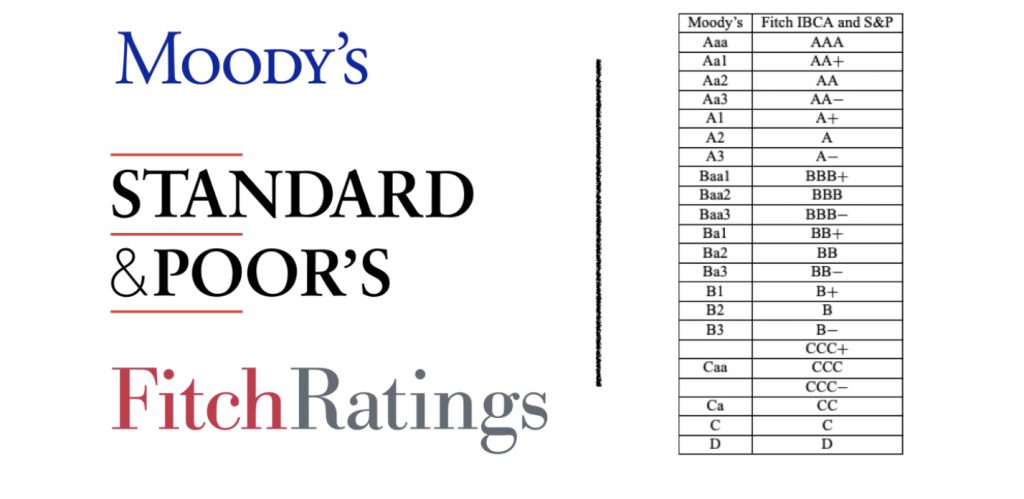

- There are close to 120 private credit rating agencies in the world but Moody’s, Standard & Poor’s and Fitch control over 90% of ratings business.

- Their business is to sell opinions based on quantitative (financial), qualitative (strategy of a company or stability of a country) and contextual data (current circumstances) data.

- They work on a range of things but are primarily known for opinions on corporate debts and sovereign (country) debts; investors can use these opinions to assess ability of borrowers to repay debts.

- Companies & countries borrow money, to run initiatives, by issuing bonds & are therefore called issuers.

- When they borrow, issuers promise to pay principal and interest to the lender.

- These ratings are considered important because they affect the ability of issuers to borrow and cost of their borrowing.

- E.g. when ratings fall, investment in the bond is seen as riskier and for riskier investments, investors demand a higher interest rate.

- Ratings agencies get paid for their opinions on companies but don’t make money for rating countries; they rate countries mostly for publicity.

- For corporates, they can be paid by the issuer or by investors (subscribers), who are looking for information to invest.

- The issuer-revenue-model is considered controversial because of conflict of interest i.e. if the issuer is paying to get rating, it can ask for a good rating to make borrowing cheaper.

- Across 3 agencies, ratings are a spectrum with AAA (best i.e. issuer will most likely repay debt) on one end and D (worst i.e. a very high chance of default) on the other.

- Between AAA & D, there are various grades such as AA+, AA, AA-, A+, … CCC-, CC, C etc.

- Around the middle is BBB-, which is considered to be the cut-off for Investment Grading; Moody’s equivalent for this is Baa3 (the rating that Moody’s downgraded India to yesterday).

- Anything below BBB- or Baa3 gets the issuer a ‘junk rating’ and most fund managers have a mandate to hold only investment grade bonds, so they start selling junk bonds, creating huge debt problems for the issuer.

Also Read: Why and how central banks increase/decrease interest rates?