Reading Time: 2 minutes

- In 2015, an anonymous person leaked 11.5 million finance-related documents (from a law-firm in Panama, Mossack Fonseca) to a German newspaper.

- After a year-long investigation, it was found that Mossack Fonseca (MF) had helped its clients hide taxable income from governments and, in some cases, clean dirty-money through creation of shell companies in tax-haven countries such as Panama, Cayman Islands etc.

- A shell company is a company that doesn’t produce anything and exists only on paper; a tax-haven is a country with zero or very low tax rates and almost a guarantee that the client information wouldn’t get exposed, thanks to the country’s heavy restrictions on information-sharing.

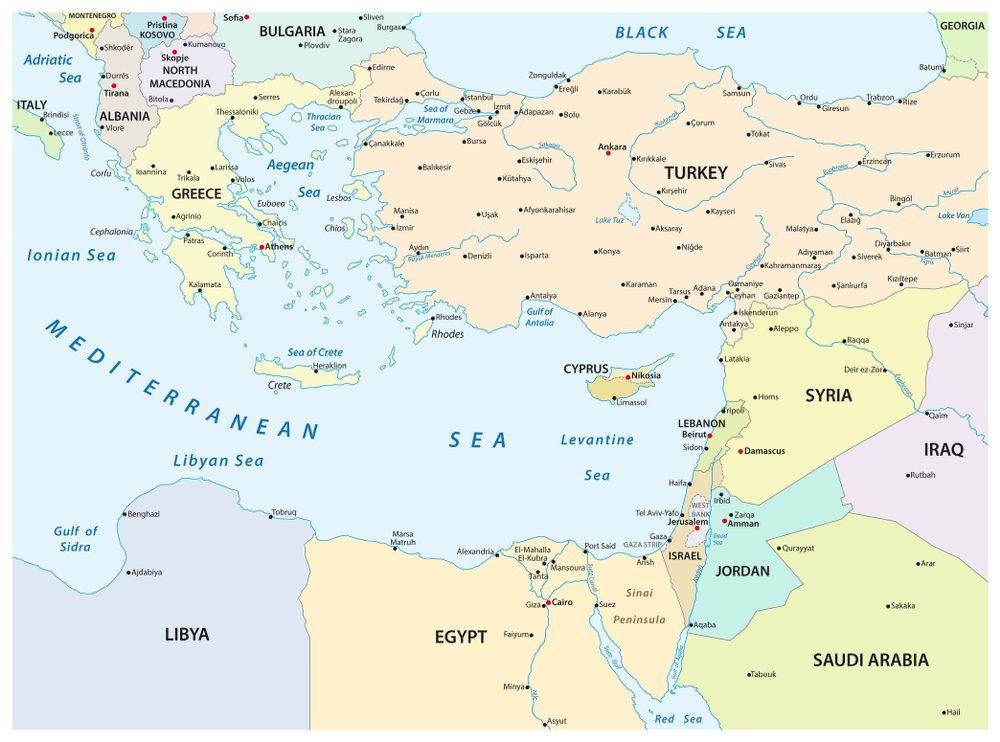

- MF was found to have been licensed by various tax havens (it operated in 21 markets) to register companies there.

- If someone wanted to register a company in one of these tax havens, MF would look after paperwork, open bank accounts and offer its own employees to act (on paper) as executives and other staff for a fee (initial + annual).

- The tax haven countries allow this because it is a big source of money for them & also provides jobs to lawyers, accountants etc.; it is estimated that British Virgin Islands alone receives $200 million from these ‘companies’ and Mauritius has 5000 employed in shell-company related jobs.

- Creating a shell company is unethical but not necessarily illegal & a lot of corporates such as Apple, Skype etc. use shell companies to save tax.

- E.g. a company in the US (corporate tax let’s say 30%) can move its patents, formula or an important ingredient of the business to its shell company in Switzerland (corporate tax 8.5%) & to access this asset, the US company will pay a hefty fee to the Swiss shell company, thereby reducing its profits (by incurring hefty cost) in the US and, in turn, tax liability.

- Individuals use shell companies for both legal (hiding money from former spouses, business partners etc.) and illegal purposes (cleaning money earned from extortion, kidnapping, drugs etc.).

- E.g. an individual in the UK can set up a shell company in Panama, which then buys another company in Cayman Islands and that company buys a property in the UK and leases it to earn rent; not only does the individual in the UK save tax on initial ‘big money’ because lack of ownership but avoids tax on the rental income from the property.

- Most of the shell companies that MF had set up were legitimate but it

was because of a few used for illegal purposes and MF’s lack of due diligence to catch those that it got embroiled in such controversy and had to close down in 2018. - E.g., as a part of the process, MF asked for identification documents to run a background check on the person opening an offshore company.

- Not everyone came out clean in these background checks, yet some of these people were allowed to open offshore companies and clean their dirty money.

- The scale of these international operations was so big that some of the cases are still being investigated and the governments are still recovering money.

Reference shelf :